17+ R&D 4 Part Test

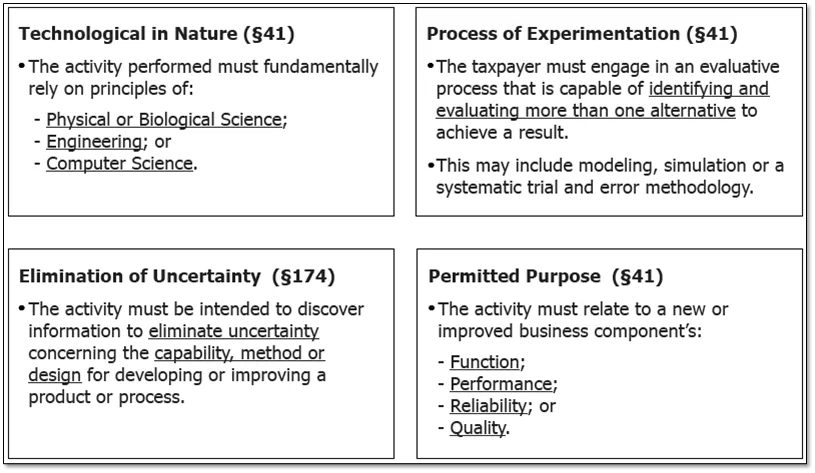

The four parts of the test are. The combination of the following tests determines if your project includes the qualifying research activities.

A Primer On Web Components In Apex

Web The 4 Part Test to Qualify for the RD Tax Credit Graham Eichman If you are considering exploring the RD tax credit advantage further it would be important to first review this.

. The test assesses the research. Web The 4-part test was created by the IRS as a tool for identifying qualifying businesses that are able to take advantage of the RD Tax Credit. Web The rd 4 Part Test helps you figure out whether your business activities qualify for the RD Tax Credit.

Web The four-part test outlines what types of activities and expenses qualify for the RD federal tax credit. Web Once youve identified potential qualifying activities run it through the four-part test to verify. Web Drilling Into the IRS Four-Part Test If your company is in an industry that qualifies for RD tax credits it makes sense to explore whether any of your operations.

Though there are some exclusions listed in the code many. To pass this requirement the activity must create or. This is the activity intended to make or.

Web The Section 174 Test In order to meet the section 174 test the expenditure must 1 be incurred in connection with the taxpayers trade or business and 2 represent a research. Web When conducting an RD tax credit study one of the first things any consulting firm will do is determine whether their clients work meets the 4-part test requirements laid out in IRC. Web The 4-Part Test There are actually four mini tests within the 4-Part Test.

Web To receive the credit you must pass a four-part test which covers the following areas. Web What is the Four-Part Test. Web You must undergo the 4-part test on a project basis.

Web The requirements of the 4-part test used to determine whether a business expense is deemed qualified for purposes of the Credit include the following. Web The RD 4-Part Test Jun 20 2019 Explore topics Workplace Job Search Careers Interviewing Salary and Compensation Internships Employee Benefits. Web RD tax credit eligibility largely depends on whether the work you are conducting meets the criteria established by the IRS in its four-part test.

What is the 4 Part Test to Qualify for RD Tax Credit. To make things even more complicated the work must satisfy each one of the tests listed. Most companies dont know that the development.

To qualify the IRS has a four-part test you must pass to be eligible to claim the RD tax credit.

Dafiti R D Semana Academica Do Centro De Tecnologia Sact Ufsm 2019

R D Tax Credit Qualified Expenses Adp

Softjourn Inc Softjourn Twitter

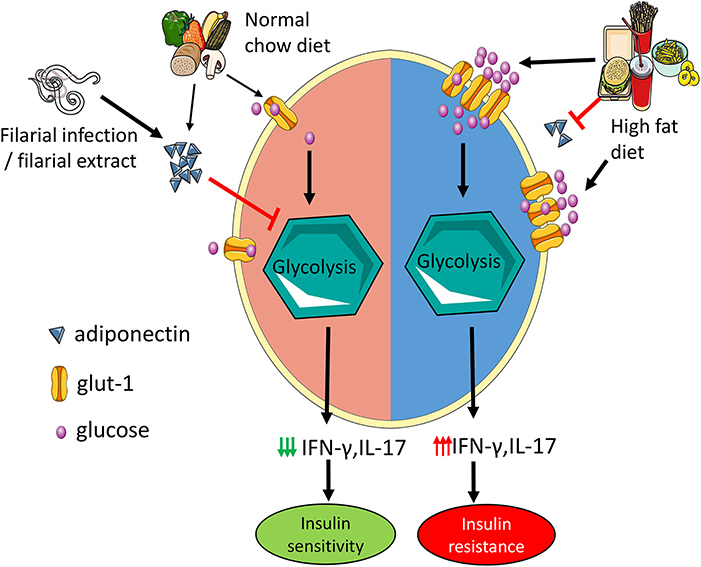

Hsv 1 Icp27 Targets The Tbk1 Activated Sting Signalsome To Inhibit Virus Induced Type I Ifn Expression The Embo Journal

R D Tax Credit Qualification The 4 Part Test Explained Leyton Us

Understanding The R D Tax Credit 4 Part Test Pm Business Advisors

The 4 Part Test To Qualify For The R D Tax Credit

Quarkus And Java 17 New Language Features Red Hat Developer

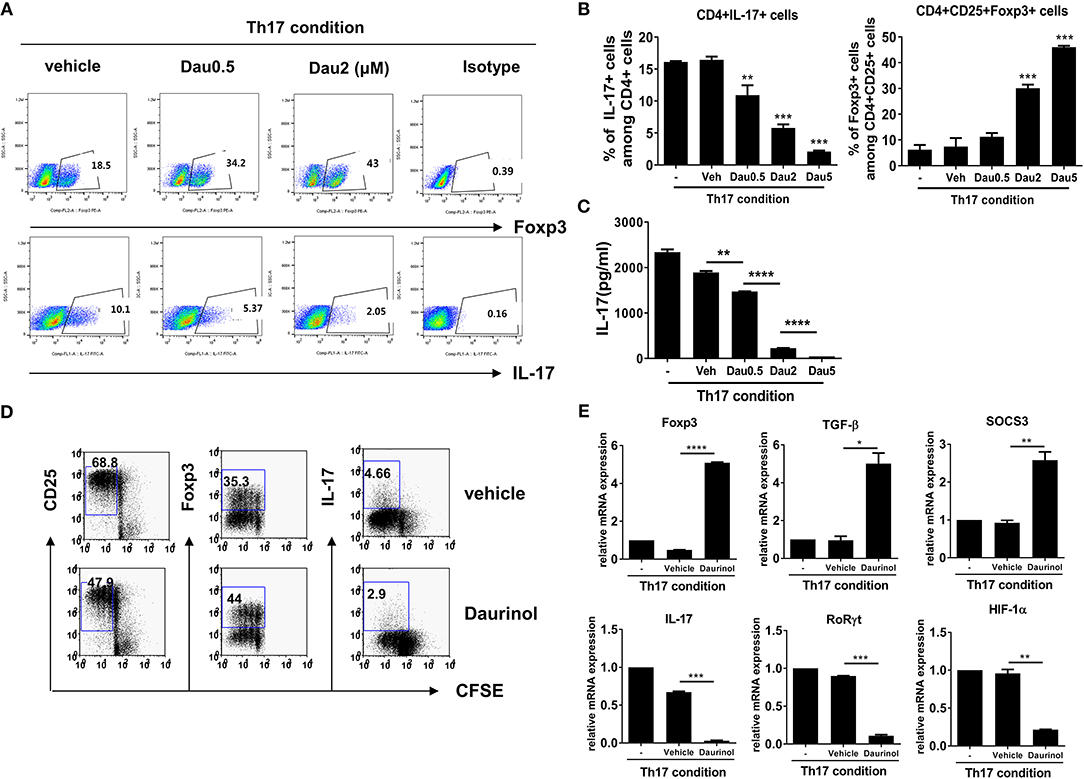

Frontiers Daurinol Attenuates Autoimmune Arthritis Via Stabilization Of Nrp1 Pten Foxp3 Signaling In Regulatory T Cells

The Four Part Test R D Tax Credit Qualifying Activities Explained

Qlik Nprinting Unsupported Qlikview Document Item Qlik Community 1714896

Team Wega Informatik Ag

R D Tax Credit Qualification The 4 Part Test Explained Leyton Us

Implementation And Validation Of Fully Relativistic Gw Calculations Spin Orbit Coupling In Molecules Nanocrystals And Solids Journal Of Chemical Theory And Computation

National Tax Group Works With You To Pass The R D 4 Part Test

The Four Part Test R D Tax Credit Qualifying Activities Explained

Pdf Charge Breeder Of Electron Cyclotron Resonance Type A New Application To Produce Intense Metal Ion Beams For Accelerators